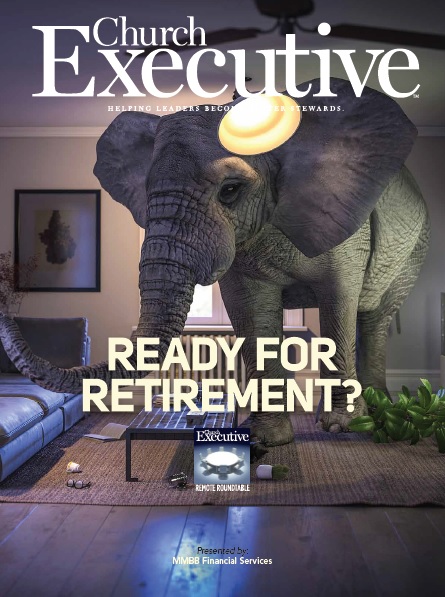

Too often, investing for retirement is the “elephant in the room.” Many professionals — particularly clergypersons — aren’t adequately prepared.

Too often, investing for retirement is the “elephant in the room.” Many professionals — particularly clergypersons — aren’t adequately prepared.

Here, a panel of CFP® professionals from MMBB Financial Services (mmbb.org) and ministry leaders bring the topics down to earth.

Their goal: make retirement investing more manageable, even (and maybe especially) if you’re advanced in your career.

CFP®, MPAS®

Director, Service Center

@ MMBB

First things first: how common is it for clergy members to avoid thinking and talking about — let alone pursuing — investing for retirement?

Alex Kim: Unfortunately, it’s pretty common. One barrier is lack of basic financial education. The financial landscape is constantly changing (tax laws and financial solutions), which demands a significant time commitment — a scarce resource for many MMBB members.

Colin Nass: That’s true. Long-term planning for retirement often requires time and effort to learn new concepts and reflect on what’s most important. So, yes, the biggest barrier in retirement planning is a feeling that the process is too difficult.

Moreover, our members are like most professionals today: they’re balancing many demands on their time and finances. It’s not uncommon to have multiple goals and focus exclusively on the most immediate issues. For many, retirement is an event “off in the future,” and this goal can get pushed aside.

Alina Parizianu: That’s true; many conflicting demands on clergy income is often the reason for lower contributions or no extra contributions. Sometimes the compensation package from the church includes the retirement contributions the church makes for the pastor, so the actual salary paid is reduced proportionately based on the contributions the church is making for the employee.

Pastor @ Humanity Baptist Church in Newark, NJ

But those who do decide to invest an additional amount automatically deducted from their paycheck early on, will have more income in retirement.

Keith Davenport: Also, I find that many clergy members haven’t prioritized retirement and investment planning because they’re focused on their ministry. So, MMBB now offers Target Date funds that are based on their retirement date and makes the asset allocation decisions for them if they’d rather not make those important investment decisions. We are also able to personally assist them with those decisions.

What about you, pastors? In your ministry careers, have you ever been reticent regarding retirement investing? It seems that you might be “exceptions to the rule.”

Robert L. DeVeaux: Correct; I’ve never been hesitant. I think that comes from my upbringing — my parents taught the importance giving back but also paying yourself first — and later, from being bi-vocational.

I was a business major in my undergraduate studies, and my professional career took off in that world. Older employees always encouraged me to get onboard with a savings plan, and retirement investing.

Director of Development Operations @ Dakota

Wesleyan University

Advancement Visionary Advisor @ The Salvation Army of Eastern Pennsylvania and Delaware

When I became paid ministry staff 21 years ago, I was exposed to the American Baptist Church, which has a long-standing connection with MMBB. Then and now — working in the educational system — I’ve played the encourager role for fellow pastors and educators related to retirement investing.

Robert G. Duffett: While I haven’t been reticent at all to discuss retirement investing, that’s because I’ve had a good pension in each place I served. My only regret is not putting more aside in my late 20s and early 30s.

What would you have set aside, ideally?

Robert G. Duffett: Even $10, $25 or $100 a month would’ve made a huge difference. Most of us probably wouldn’t miss those funds too much; it’s non-taxable income coming right out of your paycheck. It amounts to a few Starbucks trips a week.

For our financial planners: When clergy members do decide to focus on retirement investing, what are the typical catalysts?

Kim: One strong catalyst is age. As members become older and approach retirement, they’re forced to confront their fears, challenges and needs. They look in the mirror and ask how financially prepared they are for retirement.

Davenport: That’s right — they might find themselves behind on their retirement savings and have to make up for it. Through their discussions with MMBB professionals, they become more educated about the greater growth potential of some investments and more comfortable participating in their own investment decisions.

Nass: I agree — members often become more focused on retirement planning as they approach retirement.

President @ Eastern University, Dakota Wesleyan University & Palmer Theological Seminary

Leadership positions at several other academic institutions

Former pastor @ six

Baptist churches

Another common catalyst is a significant market move, which frequently gets outsized media coverage. Health concerns or a job loss can also prompt increased interest in retirement / investment planning.

Parizianu: On the other side of the spectrum, a salary increase or some extra cash flow (previously allocated to pay off student loans, or for another immediate project, for instance) can also be a catalyst.

Pastors: When did you start focusing on retirement investing, and what prompted it?

Connie G. Duffett: [Robert] and I began in our mid-30s. Our employer fully funded the basic MMBB plan, and we began to set aside as much as we could in a tax-sheltered annuity plan. We’ve done that for 30 years. We wanted to prepare better for retirement, but we also wanted the tax break.

DeVeaux: I began to focus on it about 14 years ago; but listen, it hasn’t always been feasible. Ministers are challenged to balance between living for today and living for a hope for tomorrow. Though I’ve always been bi-vocational, many times pastors aren’t abreast of the opportunities to save — and no one is encouraging them to do so, from a denominational or a church standpoint.

OK, so, having someone to help you navigate the retirement investing process is key, then. How has MMBB been a resource for you, personally?

DeVeaux: Oh, that shared insight has been huge for me.

I’ve asked MMBB financial planners to come talk to the leadership board at my church.

MBA, CPA

Financial Planning Specialist

@ MMBB

Also, I’m participating in [the Strategic Pastor Excellence Program, or SPEP], so I’m able to take our church leaders to seminars where they can sit with other diverse church leaders to understand that they’re not alone. Just to share the wealth of insight, the knowledge, has been phenomenal.

Robert G. Duffett: For 10 years, when I wasn’t employed in an American Baptist Church affiliated college, seminary or agency, MMBB was not able to accept my money due to federal restrictions. [laughs] However, when the IRS changed the policy, MMBB was able to work with members of other denominations

But for as long as we’ve been able — 40 years, now — Connie and I have found their services to be excellent and their returns competitive. Our MMBB financial planner is the person we work with most personally. He has twice created a financial plan with us. We think he’s exceptional — and fun to work with.

As you financial planners consult with clergy members, what retirement expenses are often surprising to them?

Kim: Many clergy members don’t monitor their spending, so debt management is a recurring challenge. Sometimes, debt payments can be stretched over time, or deferred, masking the real looming danger. As a result, members are unaware of how much debt they carry and how much it’s costing them in interest.

Director Financial Planning

@ MMBB

Also, many don’t diligently manage their tax liabilities, which can lead to back taxes and more precarious predicaments down the road.

Nass: I agree — figuring out monthly expenses takes several months of effort, since some expenses are seasonal (heating bills and Christmas presents) and others are infrequent (a dental filling or a car repair).

When we work with members on creating a spending plan, we make sure all expenses are identified, not just the regularly recurring expenses.

Davenport: As retirees have more time, they might tend to travel more and, with time on their hands, the desire to learn something new may be stronger than ever and costs associated with new hobbies or education may increase.

Also, some pastors might not have factored in expenses like providing for dependent adult children and grandchildren as they seek to help with college tuition and other needs.

But the expense they overlook most frequently is for increased health care needs.

Parizianu: Right; medical costs in retirement come up in every retirement conversation I have, whether a member is retiring

Financial Planning Specialist

@ MMBB

before Medicare eligibility at 65 or we’re discussing actual Medicare costs. The latter includes not only the different premiums involved (depending on the supplement they choose), but also out-of-pocket expenses (co-insurance, deductibles, co-payments).

Additionally, long-term care (LTC) costs often aren’t considered until very close to retirement, when the cost of paying for LTC insurance premiums is considered against self-insuring for this risk.

Taxes for withdrawals from pre-tax retirement accounts like 403b, 401k, or Traditional IRA might not be clear to some members.

Also, taxation of social security benefits might come into play at certain levels, for certain income amounts, which can come as a surprise. However, as MMBB is able to designate up to 100 percent of the MMBB distribution as housing allowance eligible for our clergy members, most members are able to exclude some or even all of their MMBB distributions from federal income taxes, as per IRS guidelines and limits.

Pastors, does this ring true? Have expected or overlooked expenses emerged in your retirement planning?

DeVeaux: Well, in life, things always come up, right? For instance, every time I thought I was done bettering myself vocationally … I wasn’t. It’s possible you’ll decide at 50 that you want to get your doctorate.

But these costs only pose an obstacle if you allow them to. I’ve always made sure that the savings piece was drawn off the top; then, I simply have what I have to work with. Something else had to be sacrificed, whether it was a pleasure or an automobile. I’ve driven cars as long as they’d last because I’d rather put the money aside.

Connie G. Duffett: As we made our financial plan, we discovered we could be vulnerable for assisted living care after retirement. We shopped for policies and found them not only to be expensive but also limited; many only offered two years of coverage. We decided to take the monthly premium cost for both of us and put it into a 60–40 stocks-to-bonds mutual fund, which has grown to almost $200,000. We’re also putting additional money away for health costs in retirement.

As far as college savings, our MMBB financial planner put us in the same Vanguard fund for our two children’s educations. We never used it, as we paid for our son’s college through cash and loans. And since [Robert] was a college president, our daughter went to college for free — a nice perk.

So, we’ve been blessed not to have any unexpected expenses that we couldn’t pay for in cash. We’ve been fortunate; families better off than ours have experienced misfortune or accidents in their lives.

Let’s talk more about assisted living care, as it’s an often-misunderstood retirement expense. Robert and Connie: When you say you learned you could “be vulnerable” for these costs, what do you mean?

Robert G. Duffett: Well, we knew that assisted care insurance would pay the majority of it … but only for a few years.

Connie G. Duffett: Right. If the insurance is only good for three years, say — and you’ll likely be in there a lot longer — why not just invest the cost of the premium (about $500 a month for both of us) and accrue interest? Our MMBB financial planner was able to make that work for us.

Robert G. Duffett: Now, this means rolling the dice, but we’re confident. Our plan is to build a quarter-million-dollar “nest egg” for assisted care by the time we’re in our 70s and 80s, when we might need it.

Connie G. Duffett: Yes. The point is that people need to look at their options now and start down that path. For some, getting the insurance might be the best option. We were just at a different point in the process.

Aside from these expenses, do you two feel like you’re adequately prepared (or preparing) for retirement, given where you are in your ministry careers?

Robert G. Duffett: I think we are. We saved aggressively and invested not in speculation, but in stocks — mainly through MMBB and a couple of mutual funds. There’s no guarantee, but things look good.

What about you, Rev. Dr. DeVeaux?

DeVeaux: I feel that I’m on the right path.

Through MMBB, my financial planner and I look at life expectancy, inflation, and how my investments and my savings are likely to perform along the way. Through projections, he has made me feel comfortable if I was to live to be 90.

Another thing MMBB has helped me do is reduce debt through the SPEP program. It offers the chance to meet with a cohort and to

show accountability.

Right now, I’m down to my last $2,500 in debt. That’s something I couldn’t have done on my own.

That’s great to hear! But of course, the reality is that many clergy members aren’t as prepared for retirement as the pastors in this discussion. Financial advisors: for those reading this who might be getting a late start, what’s your best advice?

Kim: Simply put: better late than never! So, kudos for finally making the move.

For these members, communication, simplicity and patience are key. It’s easy to become overwhelmed by the task ahead, so we break things down into small, easily digestible steps. This might mean tackling just one or two of the most important issues first, instead of trying to implement a massive strategic plan all at once. Most of all, we exercise patience because everything takes time.

There are many resources available online. However, the easiest way to get started might be to give us a call and speak to one of our CFP® Professionals. We can offer unbiased, comprehensive financial guidance on a range of topics.

Nass: Agreed; no two members are the same, so the best resource is a CFP® professional who can help answer specific questions: How much should I be saving? How should I be invested? How do I balance saving for multiple goals? Getting to these answers requires a tailored approach based on your unique needs and circumstances.

It’s also worth noting that time is a powerful ally when saving for retirement. This is because compound interest works best when you’re invested for longer periods of time.

Again, Target Date Funds might be an option to consider, as they provide diversification and rebalance automatically as the member gets closer to retirement — an excellent choice for members who are looking for a more automated solution to investing for retirement.

Davenport: Echoing that, I’d tell late starters to begin having more deducted from their paycheck to catch up. They can invest more in, say, stock funds for greater potential investment returns — although this comes with greater potential risk.

They might also need to review their lifestyle and expenses and reduce where possible if their retirement savings are inadequate.

Parizianu: Right. To this end, we can also look at other options: working a bit longer than anticipated to accumulate more before they start their spending stage; delaying claiming social security benefits; increasing their savings rate; or downsizing. We need to look at the impact of each of these levers on the probability of their plan’s success.

One rule of thumb when devising a plan: to live comfortably, individuals should ideally have 10 to 12 times their current salary saved by 67. When that isn’t achieved, we take stock of where each member is through comprehensive financial planning, to determine the best course of action at that point.

That is often an eye-opening conversation. It’s always going to be a tradeoff between spending today and your future wellbeing.

Do our pastors have any advice for their peers who are starting late on retirement investing?

Connie G. Duffett: Start now. Even if it’s only $10 a month.

Robert G. Duffett: I agree. Many denominational pension plans are well run, so take advantage of them.

Remember that the miracle of compounding interest is your best friend. I’m amazed at how little we invested and how interest, compounded over time, made our meager investment into something much larger than we thought possible.

It’s never too late to benefit from compounded interest. You’ll see it grow, percentagewise, as much as any billionaire would.

DeVeaux: I think you have to see your retirement savings as essential, like paying taxes. You pay those ‘off the top’ — so pay yourself the same way.

Also, be proactive. Have the retirement planning conversation at the negotiation stage when you’re accepting your call to a church. Maybe instead of being paid $70,000 a year, arrange it so that you’re paid $62,000, with $8,000 going into a retirement account. You’d be surprised: 99 percent of churches would accept that setup.

— Reporting by RaeAnn Slaybaugh

Understand your options

The right financial planner can make all the difference when it comes to retirement investing. Here’s what you need to know.

Let’s talk a bit about MMBB — what services are available for clergy members?

Colin Nass: MMBB has one purpose: improving our members’ financial wellness. As part of this mission, we offer benefit plans for churches and faith-based organizations. Members in our plans have several investment options available to them, as well as access to comprehensive financial planning.

In addition to investing for retirement, our Comprehensive Plan also provides life and disability insurance.

Alina Parizianu: MMBB helps members set financial goals, prioritize them, and work towards pursuing and achieving them. We build a plan together, whether it’s a retirement goal, debt management goal, or a college savings goal.

As a team, we understand the challenges pastors face and work with them to alleviate financial stress, from immediate, pressing goals — like eliminating credit card debt or preparing to pay IRS back taxes — to saving for a home, post-parsonage, while also having enough saved for retirement.

Alex Kim: MMBB provides retirement solutions to our clergy members, including a 403(b) retirement savings plan, group disability insurance, group life insurance depending on the retirement plan chosen, and one-on-one financial guidance through our financial planning specialists.

MMBB has built a strong reputation of partnering with our members for more than 100 years. During that time, we’ve been pioneers in clergy employee benefits, focusing on our members and aligning ourselves with their financial goals.

Keith R. Davenport: MMBB provides insights and guidance to our members through a team of senior benefits specialists in our Service Center. They provide information on MMBB plan enrollment to new pastors, lay persons and churches and assist with settling clergy member accounts at retirement. The Service Center works with beneficiaries after the death of a member and answers questions about investment options available. The Service Center also regularly updates member personal contact information with MMBB.

MMBB’s unique history and connection with the American Baptist Church makes us well-positioned to assist clergy. Ministry is at the foundation of our service mission to clergy. We are servant financial professionals.

I see that you all carry the CFP® designation. What should people be aware of when dealing with a CFP® professional?

Nass: Anyone can use the titles “financial planner” or “financial adviser.” Only those who’ve fulfilled the CFP® Board’s rigorous requirements can call themselves a CFP® professional. This includes a comprehensive CFP® certification exam and ongoing continuing education classes.

Moreover, MMBB CFP® professionals act as fiduciaries; therefore, we act in a member’s best interests.

Parizianu: Right. As part of their certification, CFP® professionals commit to the CFP® Board that they will act as a fiduciary. This means we act in MMBB’s members’ best interests, at all times when providing financial guidance.

Davenport: As a CFP® professional, the quality of holistic guidance provided to members is aligned with their financial goals. The CFP® designation should give our members confidence that they’re working with professionals who are held to high standards.

Kim: That’s true. Our planners provide something few financial advisers offer — unbiased guidance. We’re not incentivized to sell specific products or services; our loyalty lies with the client, first and foremost. So, when working with any financial adviser, be sure to ask if they’re acting as a fiduciary.

Also, there are no additional fees for working with MMBB’s financial planners. Access to financial planning is a benefit

of membership!