Financing your ministry’s project

Few topics elicit a stronger response than money — how we get it and how we use it.

Understandably, it’s also a tough subject when it comes to a church or ministry project.

If your ministry is considering putting a new wing on the church, or building a gym, or renovating the sanctuary, how do you finance the project?

• Borrow?

• Collect pledges through a capital campaign?

• Set aside savings as part of regular

expense allocation?

In many cases, the wise answer is a mix of all three.

There isn’t a simple, one-size-fits-all answer to these questions. Each ministry will need to make this decision based on its unique situation and outlook.

So, what considerations will help your team find the best answer for your own unique project?

Borrowing to fund a project

Most ministries will acquire some level of debt to complete a major project. The financial health and circumstances of your ministry will influence the amount of debt available, and at what cost. Your church’s perspectives on borrowing, governance, and ministry vision will also be key considerations when working with lenders.

Other considerations include:

•Will debt be repaid through operating budget, savings or

capital campaign?

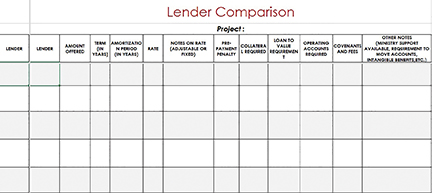

•How do you compare varying loan products, such as fixed interest versus resetting rates, balloon mortgage versus fully amortized or differing loan covenants? [ For details, read our previous series installment, Refinancing — decoding the process

•Are there other parties that need to be aware of the process, such as your congregation, a governing body within your denomination, or a current lender?

• How much would you qualify to borrow?

• What monthly payment will you make on a loan?

•How will the additional debt expense impact ministry budgets?

•What percentage of equity do we want in the project? Will a lender require more equity?

• What collateral will be used for the loan?

Saving to fund a project

Some level of saving to fund a project is always wise. You might decide to save some amount to fund the

equity or down-payment portion of a project, or set aside operating funds over a long period of time to fund all or part of the project. While saving minimizes the amount of financing needed and the interest you pay on a loan, it might increase your cost over the long term. Labor, materials and expertise are variables that can have significant swings in actual cost over time.

•Do you have savings set aside that can be used for this purpose (designated for this specific project or unrestricted)?

•Opportunity cost to ministry is also a factor. Is the time to raise or save the full amount an acceptable delay versus the ministry that could happen once the project is completed?

•Should you plan specific fundraising activities or congregational appeals?

Did you know one of Jesus’ many parables was about saving and planning for a project? Check out Luke 14:28 – 30.

Capital campaign

Conducting a capital campaign conjures a range of reactions. You might have had a negative experience with hard sell tactics in the past, or you might have seen a campaign bring in astounding resources for ministry and generously bless both the givers and the ministry. Again, the unique culture of your ministry needs to be considered as you plan a campaign.

• Do you hire a consultant?

•If so, how do you find a consultant that resonates with the vibe of your ministry and has a history of successful campaigns?

•Do you have internal expertise and experience to do a campaign well?

•What ministries can you ask for a referral to a successful campaign consultant?

Did you know the first recorded capital campaign was conducted by King David of the Bible? Check out 1Chronicles28 and 1Chronicles29.

The Bible has more to say about money and possessions than any other topic — including heaven and hell, combined. There are more than 2,350 verses that reference how we handle this precious commodity.

Kari Boyce leads Business Development at Thrivent Financial in Minneapolis, MN. Church Loans currently serves more than 1,400 Christian churches across the United States.