By Keith R. Davenport, CFP®

By Keith R. Davenport, CFP®

With the growing popularity of HGTV and other networks, homeowners are presented with glamorous home makeovers and improvement projects. It all looks beautiful on the screen, but how much will that project cost? And will it increase your home’s value?

Let’s look at the realities.

At some point, most homeowners will consider a home improvement project or renovation. Whether your home was new construction or a resale, odds are there are elements that you will want to improve or update. A well-done renovation can increase the value of your home and become a profitable investment. The renovations that add the most value to your home are the kitchen and bathroom.

When thinking about a home improvement project, there are many decisions to be made — deciding on the project itself, how much to pay for it, and if necessary, how to finance it.

First, let’s look at the project

Is it a want or a need? Wants could be a new kitchen, bathroom(s), or an additional room. Needs are structural improvements such as a new roof, siding or deck.

After you decide on the project, you will need to find a reputable contractor to perform the work. One of the best ways to decide on a reputable contractor is by word-of-mouth. Ask your friends, relatives or co-workers who they hired for their home improvement projects. Inspect the work and if you find it satisfactory, make an appointment to interview the contractor. Try to get at least five estimates for comparison. Know what you want before you get estimates so that you can compare apples to apples and choose the right contractor for the job.

In addition to a contractor who has done excellent work for people you know, be sure to ask if the contractor kept them informed about potential additional costs and the reasons they were needed. Ask people if they would hire a particular contractor again and why or why not.

Once you’ve narrowed it down, obtain and check references. Read online reviews on sites like Angie’s List, HomeAdvisor, Yelp and Google to see what others’ experiences have been and to help determine if the contractor will be the right fit for you. Also check licenses, complaints, and litigation history. Contractors and sub-contractors should be licensed through the state or municipality. Check the Better Business Bureau, state disciplinary boards and local courts for any red flags. Obtain and sign a detailed contract of the work to be performed that includes payment details, materials to be used, and deadlines for completion of the job.

The cost for home improvements varies vastly by project. Here are some things to keep in mind when it comes to payment.

Don’t pay more than 10 percent of the total cost before the project starts. You don’t want the contractor using your money to finish someone else’s project.

The contract should include a payment schedule that indicates when each installment is due. If your project requires expensive materials that must be ordered, you might have to pay for those upfront. Don’t make the final payment until the job is done.

Know what to expect

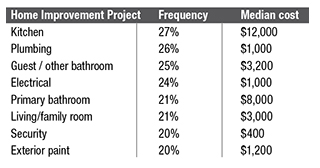

Here are the typical costs for some of the most popular home improvement projects, according to the 2021 Houzz & Home Study of more than 75,000 respondents, about half of whom renovated their home in 2020.

The kitchen is commonly the most updated room of the house, with 30% of the respondents completing a kitchen remodel or addition in 2020. The median cost was $12,000, but for larger kitchens with a major overhaul including new cabinets and appliances, the cost rose to a jaw-dropping $40,000.

Bathrooms are another popular room for renovation, with more homeowners choosing to update the guest bathroom at a median cost of $3,200 rather than the main bathroom which was 2.5 times higher.

One-quarter of the respondents updated their plumbing and / or electrical systems for an approximate cost of $1,200.

The most popular exterior update was new paint at an average cost of $1,200.

Reputable contractors who do quality work are often expensive. Here are some ways to pay for your home improvement project:

Personal savings: This is the easiest way to pay for your project if you have the funds available. Unlike financing, there’s no paperwork to complete and no interest to pay back.

Construction loan: These loans are reserved for larger projects as the funds are released directly to the contractor based on stages of construction. They are highly regulated and can be complicated to use.

Is it a want or a need? Wants could be a new kitchen, bathroom(s), or an additional room. Needs are structural improvements such as a new roof, siding or deck.

Personal loan: If your project is relatively inexpensive, a personal loan might be an option. The upfront cost is less than other types of loans, and the repayment time is shorter — typically six to seven years depending on the amount borrowed.

Cash-out refinance of your mortgage: This replaces your current mortgage with a new mortgage loan. If the cash-out loan is used to pay for home improvements, the new mortgage might be larger than the original loan amount. With interest rates remaining low, you could end up with a lower monthly payment, but the term of your loan might be extended.

Home equity line of credit: This is an option for homeowners who have enough equity. Recent property appreciation has made this a possibility for more people. Closing costs are low, and so are the monthly payments. But borrowing against your home can be risky; you could end up owing more than your home is worth, especially if values decrease.

Credit cards: This might be one of the most expensive ways to pay for your home improvements. Credit cards have the highest interest rates and are open-ended, so there is no definitive timeframe to pay off the debt. If the project is small enough, a disciplined borrower might be able to pay off the credit card balance in year or so.

There’s a lot to keep in mind when embarking on a home improvement project. The financial realities can be daunting, especially if you are not prepared for them. That’s why it’s so important to do your research on vendors, costs, and ways to pay for your project before you start.

Before you consider a home improvement project, look at the financial realities. The size and scope of your project will determine the cost. Examine your finances to ensure that a home improvement project won’t put undo strain on your budget and that the cost will be worth it and add value to your home.

Keith Davenport, CFP® leads a team of Senior Benefits Specialists as Director of MMBB’s Service Center. He has worked extensively in the financial services industry, with more than 25 years of experience, providing objective retirement and financial planning.

Davenport earned his B.S. from Morehouse College and M.S. in Personal Financial Planning from the College of Financial Planning.